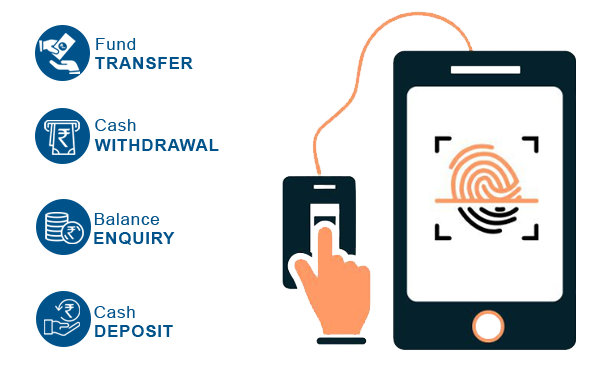

. Aadhaar Enabled Payment System (AEPS) is a payment service that

allows a bank customer to use Aadhaar as his/her identity to access

his/her Aadhaar enabled bank account and perform basic operation

related to bank account.

Aadhaar enabled payment System (aeps) is a fee device based totally

at the particular identification variety (uid) that lets in aadhaar

cardholders to perform economic transactions with no trouble using

aadhaar-primarily based authentication. Thru aadhaar, the aeps

system intends to empower all regions of society by using making

financial and banking services available to all. Aeps is an

aadhaar-enabled payment machine that permits you to transfer monies,

make bills, deposit coins, make withdrawals, and take a look at your

financial institution stability, among different things. Permit's

realize extra about aeps in this article.

AEPS aims is to build a strong foundation for a whole variety of Aadhaar empowered Banking services with several benefits and they can be summarized as below.